ebike tax credit income limit

About Form 1065 US. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

. 54A3-3 New York on the other hand provides a tax credit of 10 of the premiums for long-term care policies approved by the Superintendent of Insurance pursuant to. The Electric Bicycle Incentive Kickstart for the Environment Act establishes a consumer tax credit of up to about thirty percent of the cost of an eBike purchase. Nonresident Alien Income Tax Return.

Based on battery capacity you could receive a tax credit of up to 7500. If your looking for Other Business Services in Piscataway New Jersey - check out Tax Credits LLC. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each.

Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit. As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Ebike tax credit income limit Saturday April 23 2022 Edit. You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit. This is just a tax proposal at this stage and we can all help to make this happen.

Our simple process takes less than 15 Minutes. But Senator Joe Manchin D-WV. This means you can buy an electric bike costing as much as 5000 or more to get the full 1500 credit.

As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more. Gross Income Tax The New York Metropolitan Commuter Transportation Mobility Tax MCTMT is a tax imposed on certain employees and self-employed individuals engaging in business within the. In terms of retail price the qualifiable limit on a purchase remains 8000.

Minimum and maximum income limits apply. New Jersey allows a deduction of medical expenses including long-term care insurance premiums to the extent that they exceed 2 of adjusted gross income. E Bike Incentive Programs In North America N Eurekalert At of 10-28-21 the tax credit plan under consideration is.

Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. The credit phases out starting at 75000 of. President Joe Bidens original Build Back Better proposal included a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500.

Credit For Taxes Paid To Other Jurisdictions The New York Metropolitan Commuter Transportation Mobility Tax TAM 2010-4 Issued November 1 2010 Tax. The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly. Ad No Upfront Fees To Get Qualified - 100 Contingent On Your Payroll Tax Refund.

About Form 1040-NR US. A taxpayer may claim the credit for one. Goals of the E-Bike Affordability Program.

The proposed tax credit would not apply to any e-bike worth more than 8000. Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into service by the taxpayer for use within the United States. The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income.

Individuals earning less than 73750 annually 112500 for heads of household and 150000 for married couples filing jointly are eligible to receive the full credit on the purchase of an electric bicycle when they file their taxes. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. Tax Credits LLC is located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

The credit phases out starting at 75000 of modified adjusted gross income 112500 for heads of household and 150000 for married filing jointly at a rate of 200. Essex Preservation is an incredible renovation of 13 separate buildings spread throughout West Orange Orange and Bloomfield New JerseyCompleted in 2008 the property now offers modern 1 2 and 3 bedroom apartments. The credit would begin phasing out for taxpayers earning over 75000 though that figure increases to 112500 for heads of household and 150000 for married couples who file jointly.

Apartments are reserved for low and moderate income households. USAs e-Bike tax credit moves along but is halved 16 September 2021. Electric bicycle tax credit 2022 credit is limited to either approximately 1500 or 30 of the entire cost whichever is lower.

Ad Free tax filing for simple and complex returns. There now also exists an income based phase out of the credit applicable to those earning over 70000. E-bikes with a sticker price of more than.

Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each. Purchased bikes must carry a manufacturers vehicle identification number which. It phases out for taxpayers above those income levels.

Grab your tax docs and try our calculator.

E Bike Act Will Create Vital Tax Credit For E Bikes Calbike

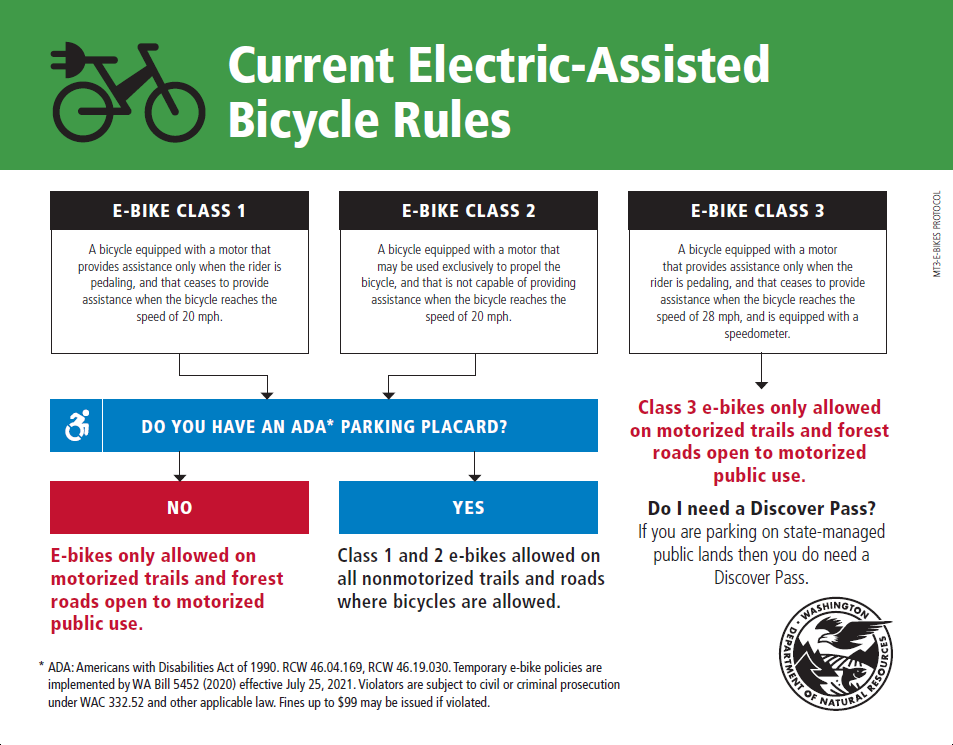

E Bike Rules And Regulations Wa Dnr

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Guide To State Local E Bike Rebates And Tax Credits Juiced Bikes

/cdn.vox-cdn.com/uploads/chorus_image/image/69626470/1311180591.0.jpg)

The Senate S E Bike Act Could Make Electric Bikes A Lot Cheaper The Verge

What Makes A Good Electric Bike Incentive Program Peopleforbikes

Us E Bike Act For 30 Tax Credit Off Can You Get An Electric Bike For Hovsco

Evolve Electric Bike Boise E Bike Ebike Electric Bike Rental

Us Tax Credit For Electric Bicycle Purchases Back Up To 30 In New Proposal

E Bike Incentive Programs In North America New Online Tracker Transportation Research And Education Center

Us Tax Credit For Electric Bicycle Purchases Back Up To 30 In New Proposal

Ebike Rebates And Incentives Across The Usa

House Committee Advances Electric Bicycle Tax Credit And Bike Commuter Benefit Peopleforbikes

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Guide To State Local E Bike Rebates And Tax Credits Juiced Bikes

Understanding The Electric Bike Tax Credit

900 E Bike Tax Credit Possible In Build Back Better Bloomberg